Month: March 2019

For option writers:

sell 28500 ce @67 tgt 1 stop 97 11.35 am for expiry 14 march

NIFTY SPOT LEVEL FOR 12/03/2019:

HOLDING 11140 CAN SEE 11194-11246

TODAY’S PROFITS IN OPTION TRADE:

FOR OPTION WRITERS:

IF BNS TRADE BELOW 27670:

SELL 27800 CE 14 MARCH BELOW 120 STOP STOP 150 TGT 90-72-50.

IF BNS TRADE ABOVE 28055 :

SELL 27600 PE 14 MARCH BELOW 70 STOP 98 TGT 40-29-15.

IF NIFTY TRADE BELOW 11000:

SELL 11000 CE 14 MARCH BELOW 66 STOP 85 TGT 47-26-14.

IF NIFTY TRADE ABOVE 11090:

SELL 11100 PE 14 MARCH BELOW 78 STOP 98 TGT 66-46-31.

STOCKS PREDICITON FOR 11/03 TO 15/03/2019:

TATA STEEL: HOLDING BELOW 500 WILL SEE 480-470 LEVELS. ONLY ABOVE 521 CAN SEE 540+

RELIANCE: TRADING BELOW 1250 CAN SEE 1221-1200 LEVELS. ABOVE 1281 CAN SEE 1300-1320.

ICICIPRULI: ABOVE 353 CAN SEE 360-375. BELOW 320 CAN SEE 310-300.

NIFTY FORMS TRI- STAR PATTERN.

DEFINITION of Tri-Star A tri-star candlestick pattern signals a possible reversal in the current trend. This pattern forms when three consecutive doji candlesticks appear at the end of a prolonged trend. The first doji indicates indecision between the bulls and the bears, the second doji gaps in the direction of the prevailing trend and the third doji changes the market’s sentiment after the candlestick opens in the opposite direction of the trend. The shadows on each doji are relatively shallow signaling a temporary reduction in volatility.

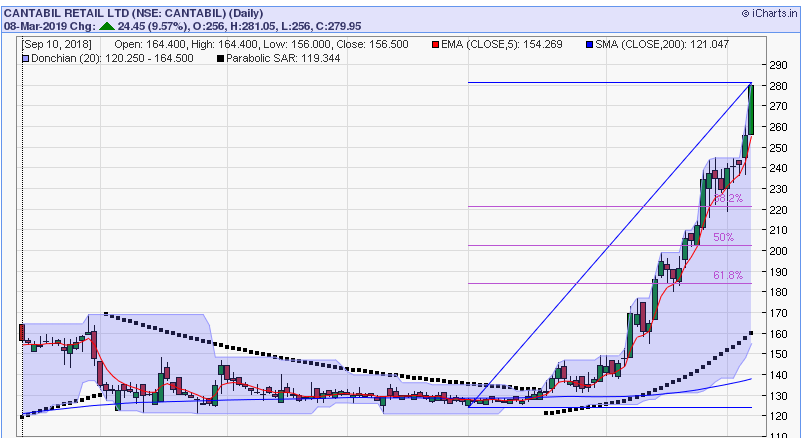

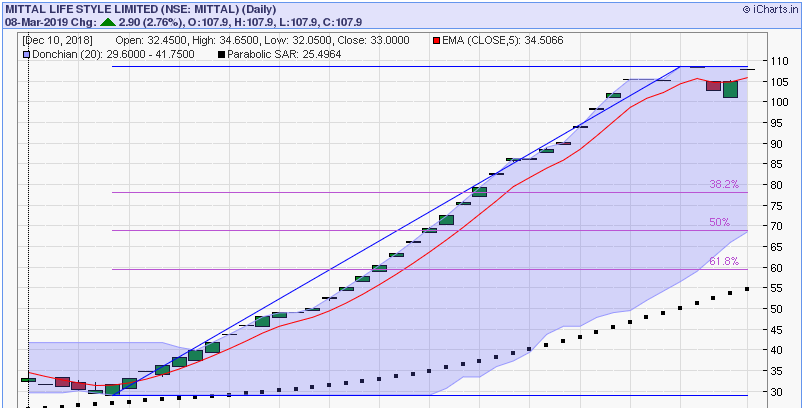

MULTI-BAGGERS STOCKS

SUBSCRIBE FOR MULTI-BAGGERS STOCKS FOR 2019-2020: GET 10 STOCKS FOR Rs.10000/- ONLY. MINIMUM RETURN 50% MAX 500%+